| |

| The year 2020 was hardly 90 days old when South Africa began to experience the massive impact of the Covid-19 pandemic on all fronts. Suddenly, by the beginning of March, it had become apparent that the country's banks would need to provide significant debt relief measures to individuals and businesses to help absorb the unforeseen and unprecedented adverse economic impact of the pandemic in response to the financial burden brought about by the sudden lockdown restrictions and regulations. Major South African banks offered their clients access to a 90-day payment holiday between April and June to help cope with the Lockdown burden. |

|

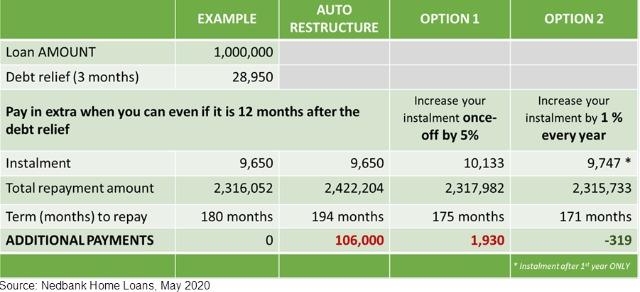

| And as Lockdown restrictions ease and South Africans are hopeful of a gradual and steady move towards normality in rebuilding our lives, the question for many of those who have taken the payment holidays lingers for an answer and guidance from the banks - what is the long-term financial impact of the debt relief measures taken up during Covid-19 in our lives post-lockdown? A long-term financial trap? Most importantly, how can that long-term financial impact be lessened? According to Thozama Mochadibane, Head of Customer Delight at Nedbank Home Loans, by mid-March up to 35 000 clients had opted for some debt relief measure or payment holiday because of either temporary reduced income or no income at all. By clients taking up these options they can go up to a period of three (3) months without servicing the monthly bond payments; and due to the capitalisation of interest and other service fees the amount that would be owing in arrears at the end of the payment holiday would be quite substantial. To ensure that arrears amount does not become a financial burden that the client would have to pay overtime, Nedbank offers an automatic restructure to clear the arrears and provide the clients with a clean slate and fresh start. Mochadibane offers that the best way to explain the impact of an automatic restructure post a payment holiday period, is to look at an example of a customer with a home loan of R1m who received payment relief to the value of R29 000 (of three instalments) within 5 years of taking up the loan. The impact of the restructure due to the capitalisation of the accumulated arrears would be the payment of an extra R106 000 over 14 months post the initial term of the loan. However, this would be the case if the customer sticks to paying the original instalment of R9 650 per month over the remaining life of the loan. Nedbank Home Loans does however offer alternatives to alleviate the financial burden. The table below illustrates the future impact of the restructure across the different options.  |

| 1) Client increases instalment once-off by 5% after 12 months. This means should a customer be in a position 12 month after receiving debt relief to increase the instalment by 5% (once-off), they will only pay R483.00 extra per month but repay the loan 5 months sooner than the original loan term. This can be done by the client with or without the bank’s involvement or assistance, through: 1) The client simply depositing the additional amount into his bond account monthly. 2) Or, a once-off request by the customer to the bank to increase his monthly debit order by this amount. 3) Or, a request by the client to the bank to restructure the loan in order to shorten his term to 175 months. All three of these choices will have the same effect on the overall cost of credit and repayment term, thereby undoing the effect of the restructure. 2) Client increases instalment annually by 1% after 12 months. Should the client be in a position 12 month after receiving debt relief to increase the instalment payment by 1% annually (as little as R100 more per month), they will pay less over the life of the loan and repay his loan off 9 months sooner than the original loan term. This can be done by the client with or without the bank’s assistance or involvement, through 1) The client simply depositing the additional amount into his bond account monthly. 2) Or an annual request by the customer to the bank to increase the monthly debit order by this amount. Both choices will have the same effect on the overall cost of credit and repayment term, thereby undoing the effect of the restructure. Mochadibane says at this stage it is difficult to determine the extent to which customers will be permanently impacted by Covid-19, but the bank is “closely monitoring our customers to ensure that they will still be in a position to afford their bond repayments." |

| Assessing a customer’s affordability underpins Absa’s lending decisions, and with the impact of Covid-19, nothing has changed, according to Geoff Lee, Managing Executive Home Loans, Absa Retail and Business Bank SA. “We realise that the COVID-19 pandemic has had a significant impact on economic activity and business operations in South Africa and that many of our customers are experiencing financial strain," says Lee. “Against this background, we recently launched a comprehensive Payment Relief Programme where customers with credit products can choose to defer payments for a period of three-months, thereby getting immediate cash-flow relief. The programme has no turnover limits or income threshold. According to Absa's Covid-19's debt relief site its "payment relief plan gives instant, short-term financial relief to qualifying Absa customers who are struggling to repay Absa credit products as a result of the COVID-19 virus and lockdown". Qualifying customers are provided with a "payment relief plan depending on their products and their circumstances". This could either be in the form of a loan term adjustment and a non-payment period of 3 months." While Absa does consider bespoke solutions for businesses based on their unique requirements and operations, it says interest will still be capitalised. "But the burden of payments during this period will be eased somewhat for customers who need it." |

| FNB customers could qualify for their COVID-19 interventions, including Instalment cashflow relief, during which part or no instalments/repayments were due for a specific period - with a preferential interest rate applied to the COVID19 relief interventions given. They also charged no fees for the relief granted. However, interest and fees continued to accumulate on outstanding balances as per normal. Standard Bank offered its personal clients a 90-day instalment relief on student loan repayments at 0% interest and a 90-day instalment relief on debt payments for customers who earn R7 500pm or less. Bond relief however had to be submitted for a tailored approach to payment holidays via its Debt Care Centre. |

| Article courtesy of Property24 |

Need more information? Fill in the form below and we will contact you! |

| |